Cryptocurrency news etrscrypto

Dubai hosted the TOKEN2049 conference, attracting over 15,000 participants, including industry leaders from BlackRock, Goldman Sachs, and Binance. Discussions revolved around crypto adoption, regulations, and shifting investor sentiment toward Trump’s policies on digital assets shazam online casino.

On the same day, Coinbase Derivatives expanded its offerings with two new cryptocurrency futures products for XRP, regulated by the US Commodity Futures Trading Commission (CFTC). These products, aimed at both retail and institutional traders, signify a positive shift in Ripple’s regulatory landscape, potentially boosting XRP’s market presence. The futures are tied to the MarketVector Coinbase XRP index and are cash-settled, catering to different investor capacities.

With the bull market getting ready for recovery, a number of cryptos are showing signs of bullish momentum building up as we anticipate a bullish phase in the next few days or weeks.Here are a number of cryptos to watch in April, with the potential to realise huge profits.

The Polkadot platform advances its ecosystem growth through parachain auctions and cross-chain features. Developers and investors choose Polkadot because they find its network upgrades efficient for maintaining blockchain scalability.

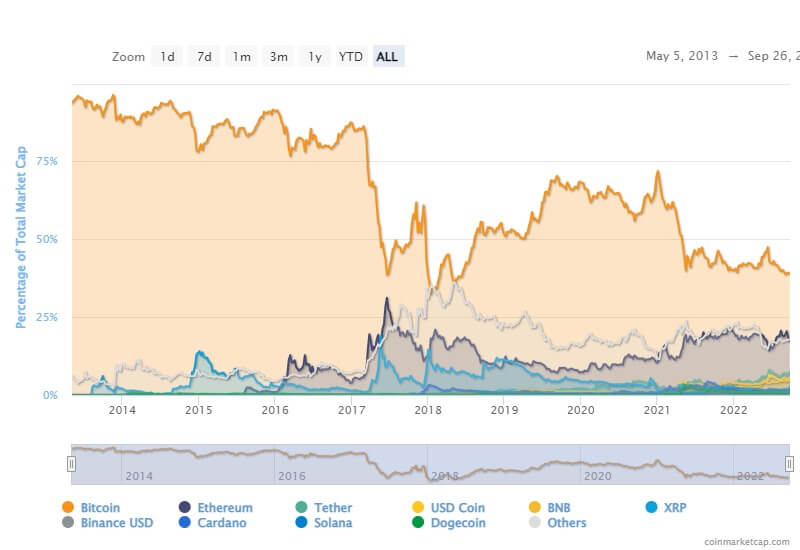

XRP gained renewed attention as rumors swirled about an ETF launch and regulatory settlement with the SEC. These developments strengthened XRP’s market position, pushing it into the top five cryptocurrencies by market capitalization.

Latest cryptocurrency market news april 2025

In 2025, Ethereum is expected to trade in a wide range with a minimum price of $1,667 and maximum price of $4,911. If and whenever bullish momentum in crypto markets accelerates, ETH may push to our stretched price target of $5,590.

The midpoint suggests a strong bullish trend, driven by ongoing institutional adoption and broader acceptance. Bitcoin’s potential to exceed previous highs remains robust, contingent on sustained market momentum in $BTC.

In 2025, Ethereum is expected to trade in a wide range with a minimum price of $1,667 and maximum price of $4,911. If and whenever bullish momentum in crypto markets accelerates, ETH may push to our stretched price target of $5,590.

The midpoint suggests a strong bullish trend, driven by ongoing institutional adoption and broader acceptance. Bitcoin’s potential to exceed previous highs remains robust, contingent on sustained market momentum in $BTC.

TOKEN2049 brings together the global Web3 industry, gathering entrepreneurs, investors, developers, industry insiders, and global media, providing an opportunity for in-depth exchange across the entire crypto industry. It is held semi-annually in Dubai and Singapore.

April was a month of major developments, from Bitcoin’s price swings to Ethereum’s upgrade and expanding institutional investments. Regulatory shifts and high-profile partnerships are paving the way for greater crypto adoption.

Ada cryptocurrency news

One Cardano (ADA) is currently worth $0.74 on major cryptocurrency exchanges. You can also exchange one Cardano for 0.00000699 bitcoin(s) on major exchanges. The value (or market capitalization) of all available Cardano in U.S. dollars is $26.26 billion.

In ADA’s case, Daily Active Addresses fell to 23,644 on Tuesday from 35,696 on May 14, extending a downtrend that started in early March. This indicates that demand for ADA’s blockchain usage is decreasing, which doesn’t bode well for Cardano’s price.

Santiment’s Daily Active Addresses index, which tracks network activity over time, paints a bearish picture for Cardano. A rise in the metric signals greater blockchain usage, while declining addresses point to lower demand for the network.

One Cardano (ADA) is currently worth $0.74 on major cryptocurrency exchanges. You can also exchange one Cardano for 0.00000699 bitcoin(s) on major exchanges. The value (or market capitalization) of all available Cardano in U.S. dollars is $26.26 billion.

In ADA’s case, Daily Active Addresses fell to 23,644 on Tuesday from 35,696 on May 14, extending a downtrend that started in early March. This indicates that demand for ADA’s blockchain usage is decreasing, which doesn’t bode well for Cardano’s price.

Santiment’s Daily Active Addresses index, which tracks network activity over time, paints a bearish picture for Cardano. A rise in the metric signals greater blockchain usage, while declining addresses point to lower demand for the network.